Darren Anton, Tax Director, KPMG Gibraltar, explains the latest changes and the potential significance for trustees in Gibraltar

Changes to the Trust Registration Service (TRS) scheme by HMRC mean that, subject to limited exceptions, all existing UK trusts and some non-UK trusts, irrespective of whether the trust has a UK tax liability, will be required to register with HMRC by 1st September 2022. The UK Government introduced the Trust Register to provide greater transparency around the ownership of Trust assets and individuals connected with trusts. Since 2017, apart from some limited exemptions, most UK and non-UK tax resident trusts with a relevant UK tax liability (i.e. Income Tax, Capital Gains Tax, Inheritance Tax, Stamp Duty Land Tax or an equivalent devolved tax, and Stamp Duty Reserve Tax), have been required to register with the TRS (referred to as ‘taxable trusts’).

As part of the registration, trustees provide certain details relating to the trust, including the identity of the trustees, beneficial owners and trust assets. Trustees are also required to keep the information up to date or confirm annually there have been no changes.

As part of the UK’s implementation of the Fifth Anti-Money Laundering Directive, the scope of the TRS was further extended in October 2020 requiring the following trusts to also register (even if they don’t have a tax liability):

- All UK resident ‘express’ trusts, unless specifically excluded. An ‘express’ trust is one which is created deliberately by a settlor (e.g. a family discretionary trust) rather than a trust created through the operation of the law or a court decision. A UK resident trust is a trust where all of the trustees are UK resident, or there is a mix of UK resident and non-resident trustees and the settlor of the trust was either UK resident or domiciled when the trust was created or further funds added, or there is a UK resident corporate trustee.

Given the significant changes and recent extension to the scope of the TRS, it is imperative that both UK and non-UK trustees review their position to assess their registration obligations in relation to both registering and updating the UK Trust Register, to avoid penalties

Obliged entity

- Non-UK resident express trusts which:

a) acquire land or property in the UK; or

b) have at least one UK resident trustee and enter into a business relationship with an ‘obliged entity’. An obliged entity could include a financial institution, an accountant, tax adviser, legal professional or estate agent etc. - Non-express trusts and certain excluded express trusts, which have a UK tax liability.

Certain trusts are excluded and are not required to register unless they are liable to pay UK tax. These include but are not limited to:

- Trusts required to open a bank account for a child;

- Charitable trusts;

- Trusts for bereaved minors or adults aged 18-25;

- Will trusts (but only for the first two years after date of death);

- Trusts imposed by courts or created by legislation;

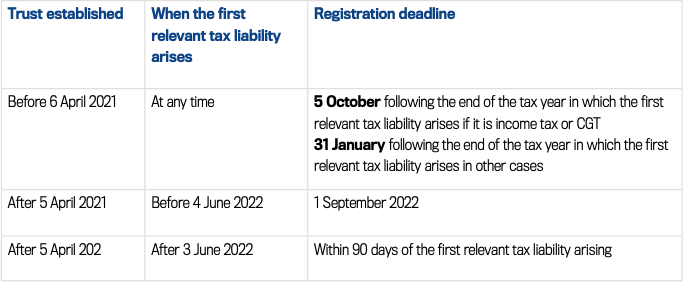

- Co-ownership trusts. It is worth noting that bare trust arrangements and employment related trusts (e.g. Employee Benefit Trusts) are not excluded and may also need to be registered. The deadline for registering a taxable trust (i.e. one with a relevant UK tax liability) depends on when the trust was established and when the first relevant tax liability arises as shown in the chart above.

Trust Register

Non-taxable trusts (i.e. those with no relevant UK tax liability) in existence on or before 6 October 2020 that meet the conditions for registration must register on or before 1 September 2022. Relevant nontaxable trusts created after 6 October 2020 must register within 90 days of being created (or otherwise becoming registrable) and 1 September 2022, whichever is the later.

In addition, the Trust Register must also be updated within 90 days of any changes to the trust details or beneficial ownership. Where the trust is taxable, the trustees must also declare on their annual Self-Assessment tax return that the Trust Register is up to date.

Given the significant changes and recent extension to the scope of the TRS, it is imperative that both UK and non-UK trustees review their position to assess their registration obligations in relation to both registering and updating the UK Trust Register, to avoid penalties. KPMG can assist Trustees with reviewing their reporting obligations in this area.